It said the investment is one of the largest foreign investments any fintech company has secured in South Africa, and will be used to boost TymeBank’s growth and accelerate it on its path to commercial success. The new investors in TymeBank are Apis Growth Fund II, a private equity fund managed by Apis Partners, and JG Summit Holdings, which is one of the largest and renowned conglomerates in the Philippines.

“Along with TymeBank’s existing shareholders, which includes majority shareholder African Rainbow Capital, the new investors are committed to growing TymeBank into a top tier retail bank in South Africa,” the bank said. “They have also entered into an agreement to launch a digital bank in the Philippines, testament to the innovation and digital banking capabilities TymeBank has built.” “Both these investors are experienced in financial services in emerging markets. Apis is a private equity asset manager that supports growth-stage financial services and financial infrastructure businesses,” it added.

TymeBank currently has 2.8 million customers and is expected to reach a milestone of 3 million customers by the end of March 2021. The bank is celebrating its second anniversary this month, having officially launched on 26 February 2019. TymeBank said it adds an average of 110,000 new customers per month, adding that the pandemic has increased demand for its services. “The onset of the COVID-19 pandemic has led to increased demand across all customer income groups in South Africa for digital banking options,” TymeBank said.

“This supports TymeBank’s goal to grow its customer base to 4 million by 2022.” The bank said it plans to greatly expand its product offering, a plan which will be enabled by this new investment. It aims to launch insurance products, credit cards, and other value-added services to customers in future. “As the controlling shareholder in TymeBank, African Rainbow Capital is delighted to have our new co-investors onboard,” said African Rainbow Capital chairman Dr Patrice Motsepe.

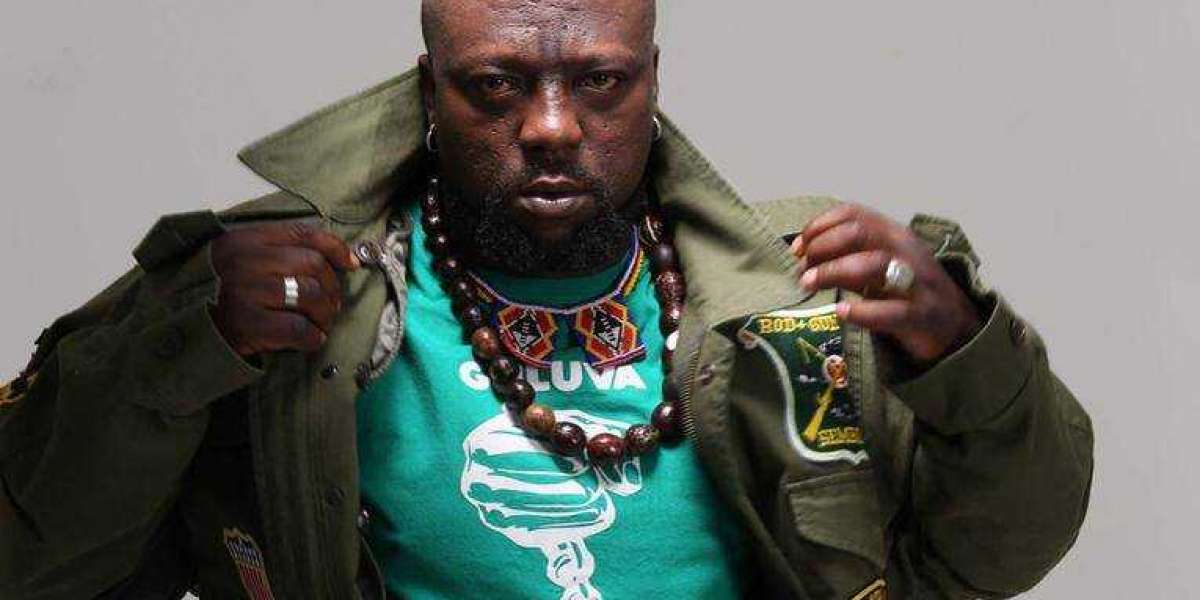

“The invested amount of R1.6 billion is no small feat – both in terms of drawing investment into South Africa’s financial services sector as well as investing into a fledgeling part of the sector in our country.” “We look forward to a long-term partnership with Apis and the Gokongwei family,” he said. All the parties involved in the R1.6-billion investment are pictured below.