“This action is the largest fraudulent scheme involving Bitcoin charged in any CFTC case,” the regulator stated. MTI was a Bitcoin-based network marketing scam that began in South Africa and drew in members worldwide. It promised to grow members’ Bitcoin with yields averaging 10% per month. Members could also obtain substantial bonuses by recruiting more people into the scheme. MTI made headlines in September 2020 when a group calling itself Anonymous ZA exploited vulnerabilities in its poorly-coded website.

Together with a MyBroadband journalist and community members, the group exposed the inner workings of MTI. South Africa’s Financial Sector Conduct Authority executed a simultaneous dawn raid on three MTI-linked locations on 26 October 2020. By November 2020, reports started surfacing of people who struggled to get their money out of the scheme. In mid-December, Steynberg disappeared while travelling in Brazil and MTI collapsed. Liquidation proceedings were instituted shortly after that. At its height, MTI claimed to have over 160,000 members.

Sources with knowledge of MTI’s liquidation have told MyBroadband that over 46,000 bitcoin flowed through the scheme. Chainalysis named MTI the biggest cryptocurrency scam of 2020. The CFTC filed its enforcement action in the Western District of Texas. In addition to fraud, it charged Mirror Trading International and Johann Steynberg with registration violations. According to the CFTC’s complaint, MTI and Steynberg as its principal agent accepted at least 29,421 Bitcoin from at least 23,000 individuals from the United States. The CFTC said that over the relevant period, the Bitcoin was worth over $1,733,838,372 (R28 billion).

It is interesting to note that the CFTC is using an average price of $58,932 per Bitcoin. When MTI collapsed on 22 December 2020, Bitcoin had set a new all-time high price of around $24,000 per Bitcoin. However, the CFTC complaint asserts that Steynberg’s activities continued beyond MTI’s apparent collapse to end-March 2021. This is significant, as Bitcoin’s price hit over $61,000 in mid-March. “The complaint charges that from approximately 18 May 2018 through approximately 30 March 2021, Steynberg, individually and as the controlling person of MTI, engaged in an international fraudulent multilevel marketing scheme,” the CFTC stated. “In its continuing litigation, the CFTC seeks full restitution to defrauded investors, disgorgement of ill-gotten gains, civil monetary penalties, permanent registration and trading bans, and a permanent injunction against future violations of the Commodity Exchange Act and CFTC Regulations.”

The CFTC cautioned victims that restitution orders might not recover lost money because the wrongdoers may not have sufficient funds or assets. However, liquidators of the MTI estate in South Africa have thus far recovered 1,281 Bitcoin that MTI’s former brokerage, FXChoice, had frozen. They liquidated the assets immediately after repatriating them and fortunately received a relatively favourable rate, selling the Bitcoin for over a billion rand.

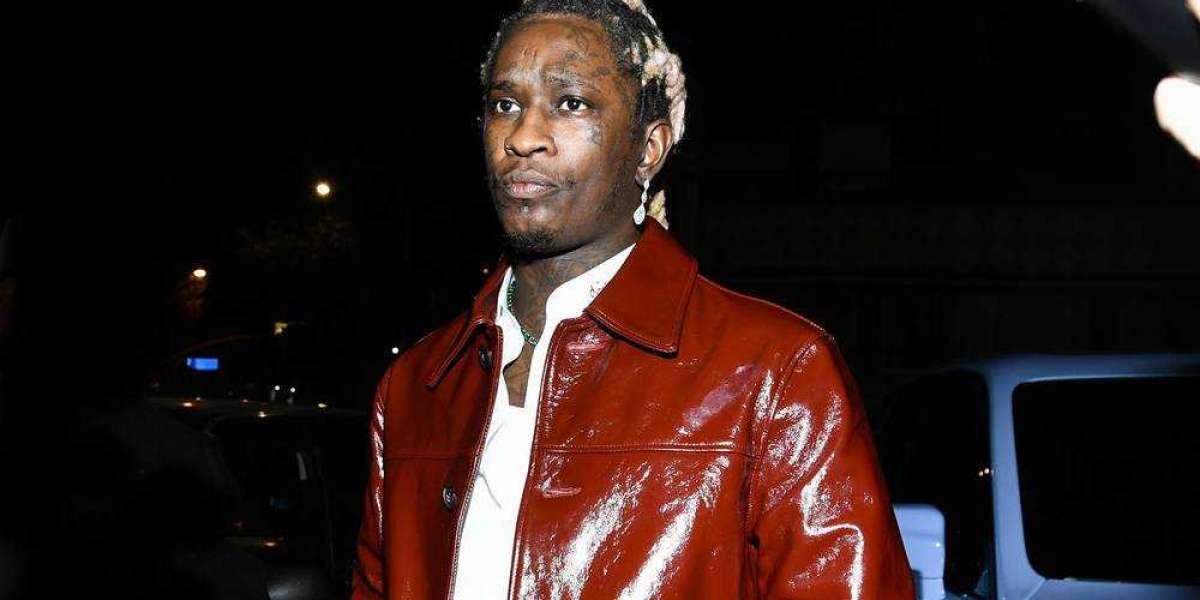

Steynberg was arrested in Brazil on 29 December 2021 — almost exactly a year after he first went missing. He allegedly presented a fake ID when officers approached him in the city of Goiânia, the capital of the Brazilian state of Goiás. Brazilian federal police apparently identified Steynberg as an international fugitive thanks to an Interpol Red Diffusion notice. He is currently detained in Brazil and awaiting an extradition hearing. In its application for the Interpol Red Diffusion, South Africa included the following charges against Steynberg: Conducting financial services without a licence Conducting a derivatives business unlicensed Trading in financial products without a license Fraud Theft Money laundering Steynberg argued to be released from custody and be placed under house arrest while he waits for his extradition hearing. However, Brazilian supreme court justice André Mendonça was unconvinced that Steynberg wasn’t a flight risk and ordered he be kept under arrest. Steynberg could not be reached for comment.