And is it a good idea when you’re financing the car of your dreams? Let’s jump in.

What is it?

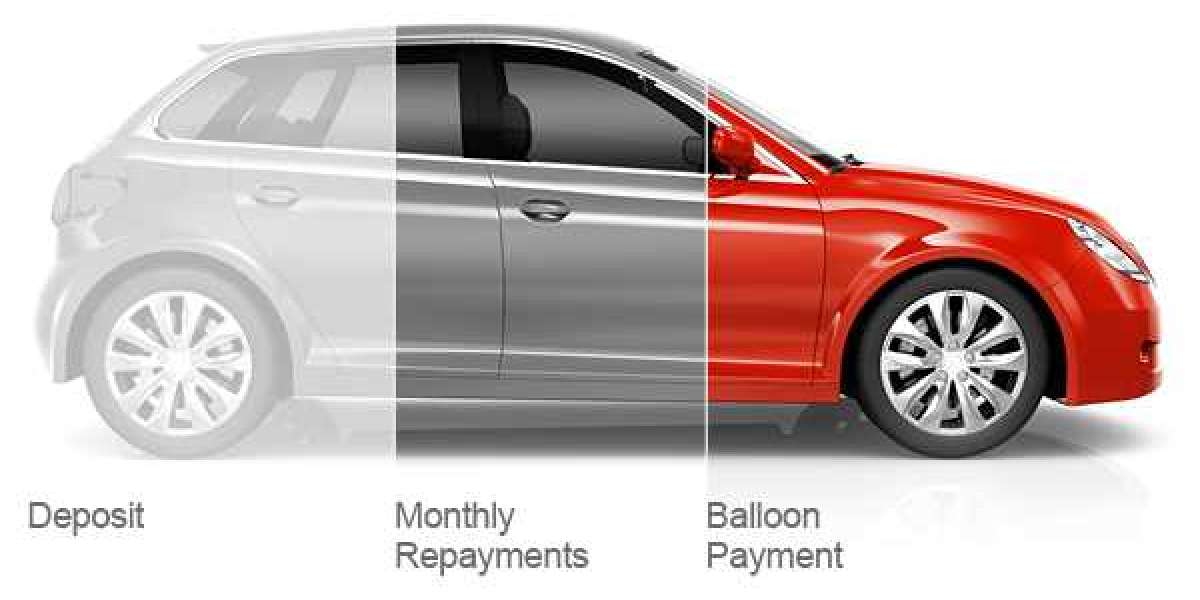

Put simply, it’s a lump sum due at the end of a loan term. To illustrate the concept, let’s compare two car loans for R350,000 – one with a balloon payment and one without.

With no deposit and no balloon payment, and assuming an interest rate of 10.5%, the monthly instalment on the full amount would be about R7,600 over 60 months (five years).

Now, let’s say you choose a balloon payment of 20% instead. R70,000 of the initial R350,000 is immediately removed, and your monthly instalment is calculated on a reduced total of R280,000 – about R6,500 over 60 months.

But what happens to that R70k? You still have to pay it back at the end of the loan term, and you have to pay it back as a lump sum…

Why is it dangerous?

A balloon payment is a way to delay your debt and puts you at risk of a cash crunch in the future. People who choose this option often can’t afford the full monthly repayment, which means they’re actually buying a car that’s beyond their means.

Using the example above, most of us would love to believe that although we don’t have R70k now, we’ll definitely have it in five years’ time… Sadly, that’s not always the case. If you can’t come up with the balloon payment at the end of the loan term, you’ll be forced to take out another loan or sell the car you’ve just spent years paying off.

What if you plan to sell your car in five years, settle the balloon payment and get a new car? Fair enough, but say your car gets stolen or written-off in a crash? Or you don’t manage to sell it for the right price? Or the bank doesn’t approve the finance for your next car? There are no guarantees! That balloon payment could end up putting you in a bad debt cycle that will be hard to escape from.

Are there any benefits?

There are some advantages to a balloon payment, but only if you’re financially savvy and you know exactly what you’re doing. A balloon payment obviously makes it easier to finance a car, and it might make sense if you want to trade in your car every five years – as long as you’re aware of the dangers mentioned above.

A balloon payment can also be a good idea if you're 100% sure that you’ll be able to afford the lump sum payment. For example, if you already have the lump sum amount saved up, you could invest that money for five years and make some moola, instead of giving it all back to the bank on a monthly basis.

I have a loan with a balloon payment – help!

There’s no point stressing about where you’ll find the money. Rather be proactive: contribute a little more to your monthly instalments to reduce the size of the end payment; or use any spare money – like your December bonus or a tax rebate – to save towards the lump sum.

Good luck, and remember: the sooner you can be debt-free, the happier you’ll be.